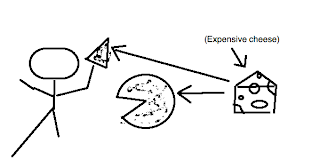

Definition: The equilibrium price is the intersection point between the Supply and Demand curves when you plot them on the same graph. The way that translates in the real world is the actual price of whatever it is that we're analyzing with such complex mathematical tools (hopefully we can both agree that they're not really that complex). When you think about it, it's essentially a compromise between a consumer, who wants everything to be incredibly cheap, and the producer, who wants to sell incredibly expensively. If either party dominates, naturally one of them will lose, and that's bad for business!

Definition: The equilibrium price is the intersection point between the Supply and Demand curves when you plot them on the same graph. The way that translates in the real world is the actual price of whatever it is that we're analyzing with such complex mathematical tools (hopefully we can both agree that they're not really that complex). When you think about it, it's essentially a compromise between a consumer, who wants everything to be incredibly cheap, and the producer, who wants to sell incredibly expensively. If either party dominates, naturally one of them will lose, and that's bad for business!MOAR: